can you look up a tax exempt certificate

The presumption is that all sales of tangible personal property are taxable unless specifically enumerated. If you are unable to find a listing for an organization that you believe is exempt you may contact us by email or call us at 800-252-5555.

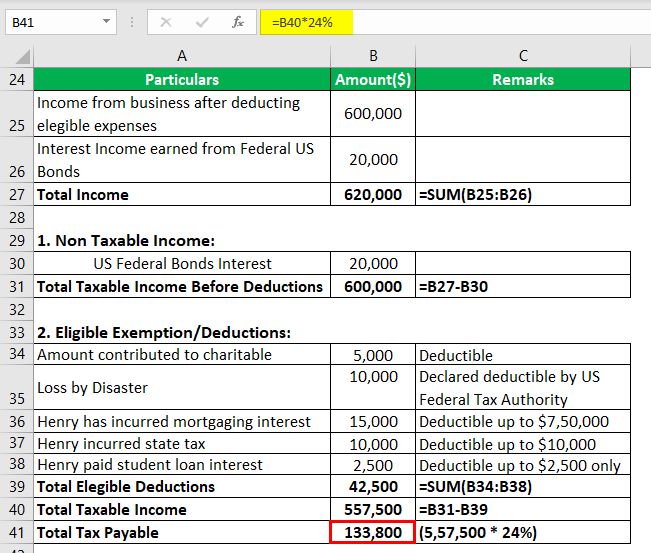

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

You can also search for information about an organizations tax-exempt status and filings.

. Select the one for your own business. District of Columbia Click Certificate License Search. This will take you to a screen that shows your business information including your tax exempt number.

UpCounsel accepts only the top 5 percent of lawyers to its site. Even though the statutes may clearly identify an exemption you still have the burden of proof to support any untaxed sales. Georgia Visit Georgia Tax Center Click Licenses Enter the required information.

Florida Enter the required seller information then enter sales tax certificate numbers for verification. Request Exemption Verification Taxpayer Number. An IRS agent will look up an entitys status for you if you provide a name address and employer identification number.

Automatic Revocation of Exemption List. Skip to Main Content Search for. This includes blanket certificates of resale as well as exemption certificates.

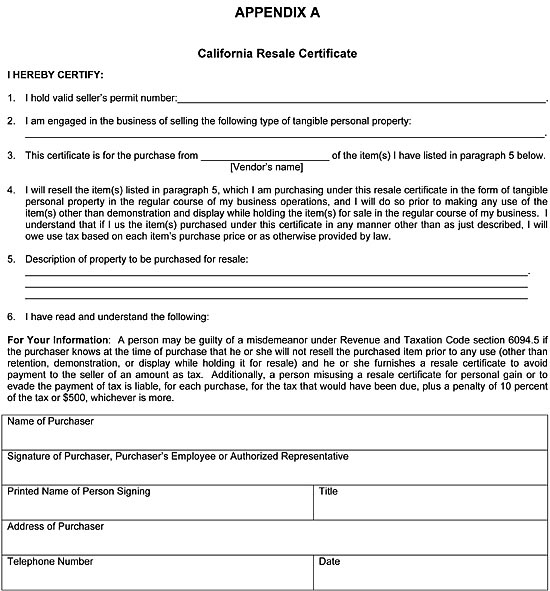

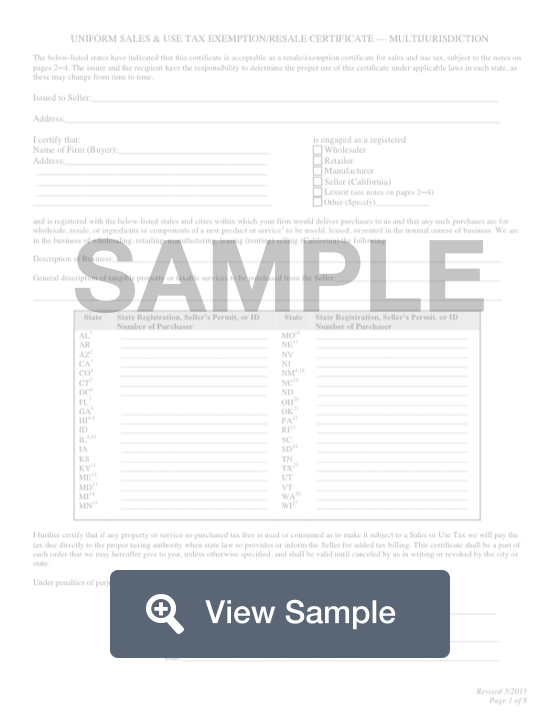

Buyers may also be able to use the Uniform Sales and Use Tax Exemption Resale Certificate see page 2 or contact the states revenue department for state-specific information. You can search Pub78 data for 501 c 3 or other organizations eligible to receive deductible charitable contributions or the Exempt Organizations Business Master File Extract for other 501 c organizations to find out if the organizations tax- exempt status has been reinstated. File a completed Application for a Consumers Certificate of Exemption Form DR-5 with the Department.

Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must check box D Foreign Diplomat and include the number displayed beneath the photo on their tax exemption identification card. If you need help with how to get a tax exempt certificate you can post your legal need on UpCounsels marketplace. You can also ask to see an entitys IRS determination letter recognizing it as tax exempt.

The IRS maintains an electronic database on its website that you can use to check the tax-exempt status of any company or organization. You need only one NTTC from a customer to cover all transactions of the same type with that customer. Form 990 Series Returns.

A Nontaxable Transaction Certificate NTTC obtained from the Taxation and Revenue Department allows you as a seller or lessor to deduct the receipts from qualified transactions from your gross receipts. Form 990-N e-Postcard Pub. The Department of Revenue recently redesigned the certificates the Department issues.

While these certificates now look different the old certificates are still valid as. Click Search to find names of businesses and business owners that match the names you have entered. Connecticut Enter the business ID and certificate number.

You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data. Verification of a Diplomatic Tax Exemption card is available through the tax card verification database of the US Department of State. A tax-exempt resale certificate can usually be obtained by a business from the state or local tax office.

Buyers can click here Form 1746 to apply for an exemption certificate and must provide a completed Form 149 Sales and Use Tax Exemption Certificate to the seller. You may use the electronic certificate S-211E to claim an exemption from Wisconsin state county baseball stadium local exposition and premier resort sales or use taxes. Click here for a list of Direct Pay Permit holders.

UpCounsel accepts only the top 5 percent of lawyers to its site. Provide a copy of the statute or law creating or describing the federal or state agency county municipality or political subdivision with your application. Another way to check the tax exempt status of a company or organization is to call the IRS directly at 1-877-829-5500.

Tax Exempt Organization Search Tool. More information can be obtained from the individual state tax office website. Generally an exemption is a statutory exception that eliminates the need to pay sales tax.

An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase. Fully complete the information in tabs 1 through 4 before providing your vendor with an electronic copy of the certificate or a printed and signed copy. 2022 Comptroller of Maryland.

However a business requires a federal Employer Identification Number EIN first before applying for a tax-exempt resale certificate.

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Printable California Sales Tax Exemption Certificates

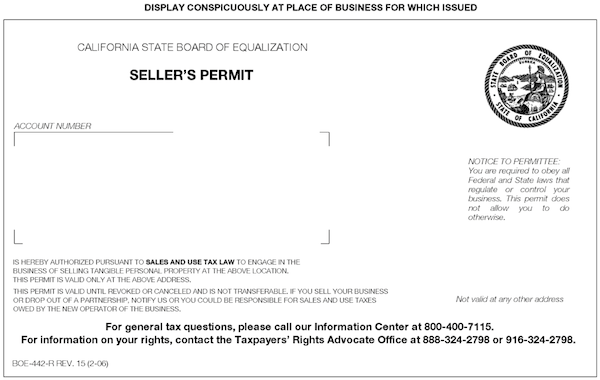

Sellers Permit Vs Resale Certificate Mcclellan Davis Llc

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Free 10 Sample Tax Exemption Forms In Pdf

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Tax Exemption Form Free Tax Exempt Certificate Template Formswift

Free 10 Sample Tax Exemption Forms In Pdf

How To Register For A Tax Exempt Id The Home Depot Pro

Free 10 Sample Tax Exemption Forms In Pdf

Resale Certificate How To Verify Taxjar

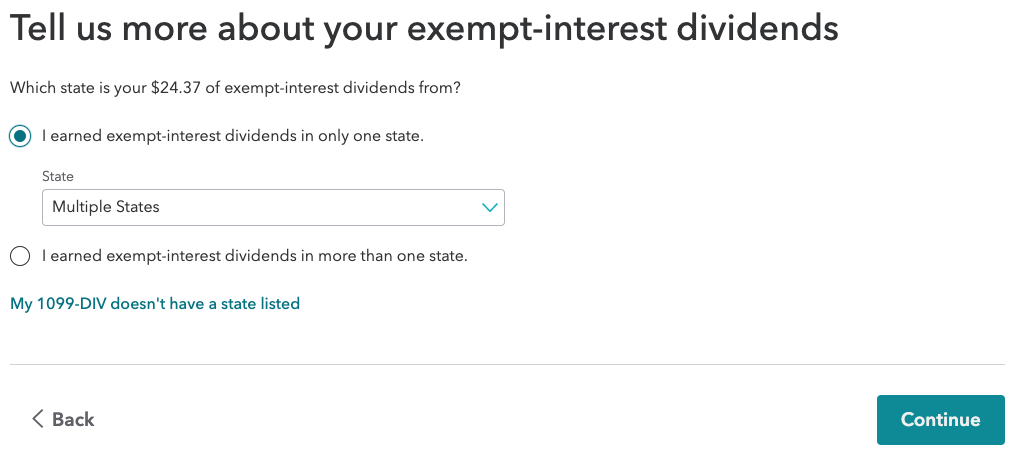

How Do I Address Exempt Interest Dividends In My Tax Return Or Tax Software Wealthfront Support

Sellers Permit Vs Resale Certificate Mcclellan Davis Llc

How Do I Know If I Am Exempt From Federal Withholding